Tips to Building a Healthy Culture That Can Grow Your Business

We are focused on building a long-term business.

Heck, we are at the 11-year mark so we are learning and applying what we learn.

Without a doubt, at the foundation of that is people.

And the people need vision, clarity, values, and a mission to get behind.

Prompts to get everyone aligned and moving in the same direction.

People also need to be supported, heard, cared for, and loved.

Yup, you heard that right, loved.

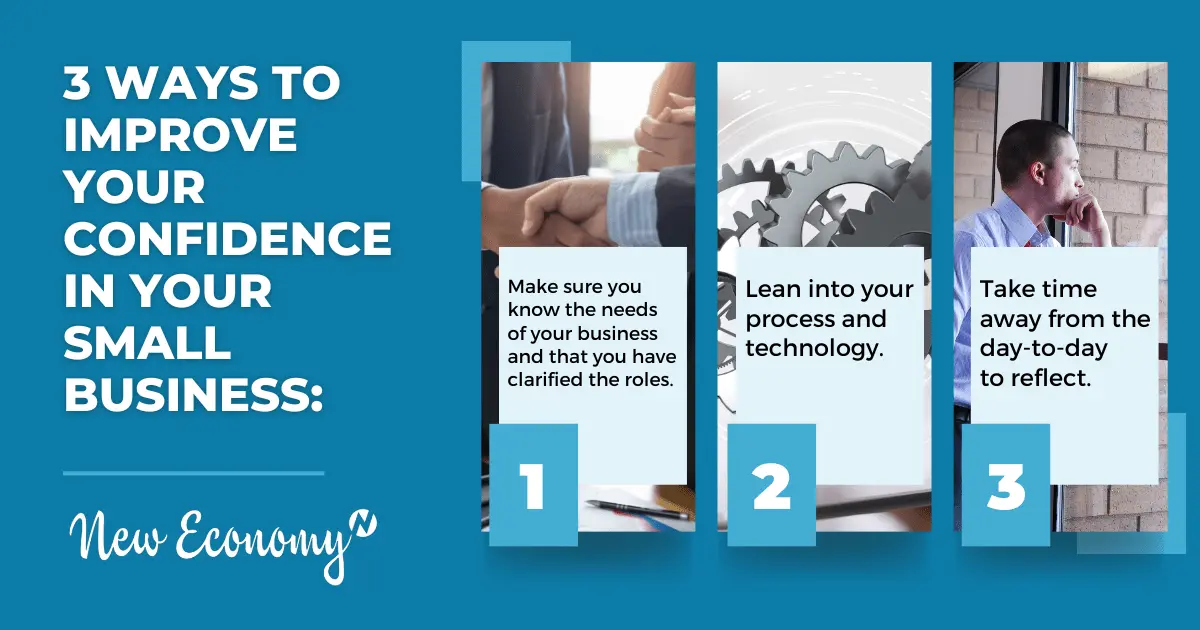

If you are building a business or organization, culture should be a top priority. You should be constantly thinking about how to shape, cultivate, and prune the culture.

Before we jump in, here are a few reflection questions for you:

- How would you rate the culture in your organization on a scale of 1-10?

- How do you define culture? And what does a healthy culture look like?

- What investments are you making to nurture the culture that you are looking to build?

As for us, we let our customers rate us. We believe that the awesome service we strive to deliver is a reflection of the culture we have created. So we ask our customer.

Check out what clients are saying here.

We believe that culture can be defined as a set of attitudes, behaviors, and practices shared within an organization which gives it a distinctive identity.

And as for investments, we make lots.

We have developed a care team, called Wrap Around, to care for our employees. We constantly clarify our mission, vision, and values and share ways the employees can participate in building culture. And we set aside time each month to just have fun together. But more on that later.

We believe that one of the single most important investments you can make in your business is in creating a healthy culture. And this is critical in supporting the growth of the business.

In this article, you will learn about:

- Why culture matters

- Who’s responsible for creating and building a culture

- Key investments to make in culture

- Top 3 Takeaways

Let’s dive in.

Why Culture Matters

Legendary management expert Peter Drucker said that “Culture eats strategy for breakfast”.

Ain’t that the truth?

We believe that culture sets the foundation.

It sets the tone for how your people operate, communicate, treat each other, make decisions, and treat your customers.

Want more?

It also sets the tone for how you hire, how you fire, and how you promote. It helps you identify customers, vendors, and partners that will align well with your organization.

In Built to Last, Jim Collins discovered that enduring companies have a culture that defines who they are and what they value to attract like-minded individuals to them.

People who fit the culture know what to do because they can feel why it is important. Conversely, those that don’t fit the culture feel out of place.

Culture matters because it scales.

It permeates every aspect of the business.

We are living proof of this.

Here are some outcomes of a healthy culture that we have experienced:

- Lower employee turnover and higher engagement

- Increased profitability

- Increased job satisfaction

- Stronger relationships built on trust

- Less time wasted on non-sense such as gossip, here say and drama

- Higher probability of achieving Company and Individual goals

- Alignment and focus on the greater good

Here are some outcomes of an unhealthy culture that we have witnessed:

- Higher employee turnover and lower engagement

- Decreased profitability

- Decreased job satisfaction

- Weaker relationships

- More time is wasted on non-sense such as gossip, here say, and drama

- Lower probability of achieving Company and Individual goals

- Lack of alignment and focus on the great good.

As you can see there are healthy outcomes related to a healthy culture.

And there are unhealthy outcomes relating to an unhealthy culture.

In our experience, this is a very important part of any organization.

We believe that there is no silver bullet and it takes time to create, shape, and build a culture that will last.

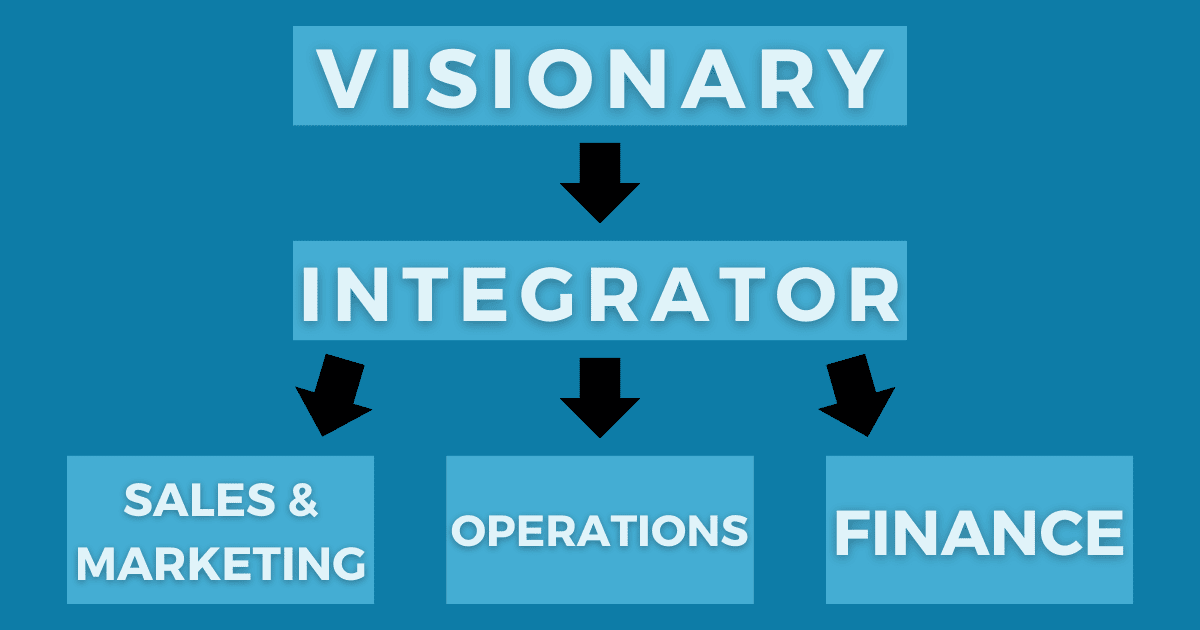

Who is Responsible for Creating and Building Culture?

We believe that everyone has a role in creating and building culture.

From the newest team member to the most experienced team member folks will be either adding to or taking away from culture.

But the buck stops with the CEO or Visionary.

The CEO needs to take ownership of the culture.

Sure we want to get the leadership team involved. This will help to multiply the efforts and bring the culture alive in the organization.

A key point is that if the CEO does not create, and then support, the building of the culture someone else will.

Do you want your unhappy employee, who is not a right fit for your company, to go around and create the atmosphere in the company?

Probably not.

So the leadership team needs to do some groundwork in the following areas to set the baseline:

- Define the mission

- Define the vision

- Define the core values

Then the leadership needs to take the following steps to build the culture:

- Remove employees or customers that are not a core value fit

- Provide positive feedback to employees living in the culture

- Provide constructive feedback to employees not living in the culture

- Bang the drum and constantly get the Mission, Vision, and core values in front of the team

At New Economy, we have a quarterly company rollout. During that meeting, we review and bang the drum on the Mission, Vision, and Core Values.

Also, we use Slack as an internal communication platform. We have a channel called core value callouts. We encourage employees to “call out” an employee and give recognition when a core value is being lived out. This helps with positive reinforcement.

There are so many different directions you can take this in.

The Company needs a Core Value Champion which is typically the CEO.

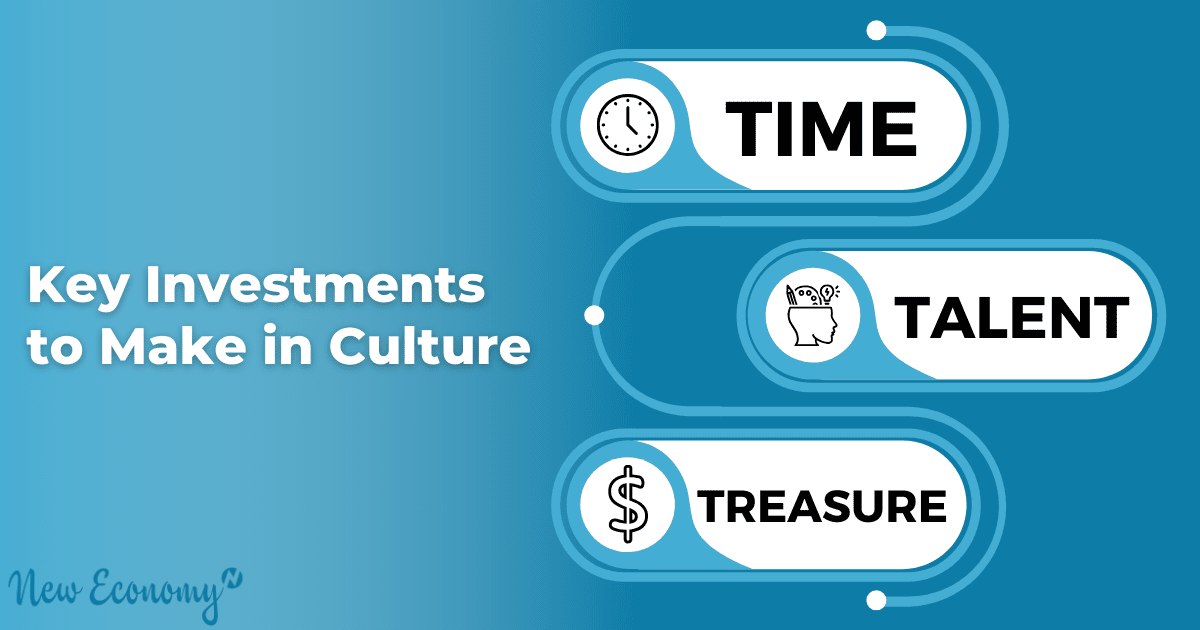

Key Investments to Make in Culture

A healthy culture takes investments.

It takes investment in time, talent, and treasures.

The more you invest, the bigger your return.

Are you willing to make investments in your organization’s culture?

Investments in Time

We believe that building a healthy culture happens over a period of time, and it is a lifelong pursuit.

Here are some of the examples of investments that we making in time at New Economy:

- Monthly Culture Zoom – All employees participate. This is a fun event where we create time and space to get to know each other and have fun. It is not work-related.

- Quarterly Wrap-Around Zoom – All employees participate. We have a care team called Wrap Around. Each quarter they host an event to “wrap their arms” around the team. Our last topic of discussion is generosity in the workplace.

- Monthly One-On-One Zoom – All employees participate. Our first question on these is “How are you doing and how can we help?” We make these about the employees and try to remove obstacles that are preventing them from being successful.

Investments in Talent

We believe that Companies rise and fall based on leadership. As we noted above, the Leadership team has a responsibility to create a culture.

Here are some of the examples of investments that we making in talent at New Economy:

- We have training budgets for all team members of about $1,000 per year.

- We invite all team members to attend the Global Leadership Summit.

- We have created a Leadership Team Oath that leaders put into

- We have our leaders participate in coaching programs like C12, Key Players, and How to Be a Good Boss

Investments in Treasure

All we are referring to with treasure is money. Beyond developing talent and creating time for developing culture it takes monetary investments.

We have mentioned a few above in the form of the value of time through meetings and training.

Here are a few more.

- Above we mentioned our Wrap Around team. They invest $50 per month to partner with each employee in investing in a charitable organization picked by the employee. This is $600 per year of cash donated to good causes.

- Above we mentioned our Wrap Around team. They invest $50 per month to partner with each employee in investing in their emotional, spiritual, and physical well-being. Think gym memberships, meditation apps, and meal delivery services. This is $600 per year of cash donated to good causes.

Building a healthy culture that will last takes time.

Also, it takes investments in the form of money, talent, and more time.

But it is so worth it.

Imagine working at the place you always dreamed of working.

You can make that happen by investing in building and growing your organization’s culture.

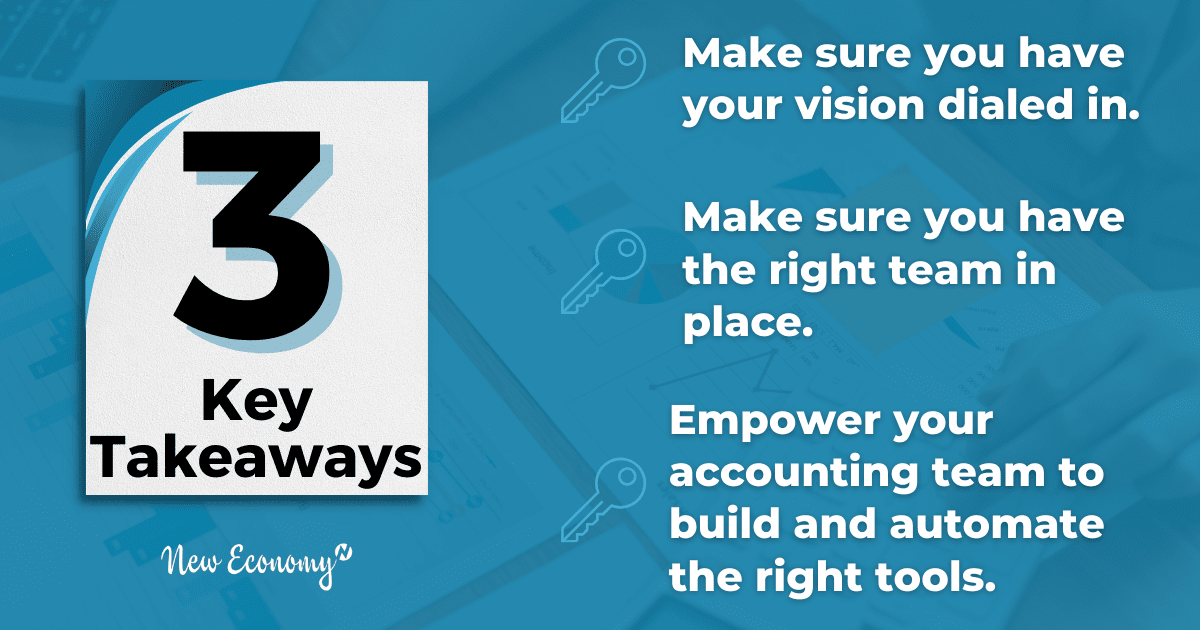

3 Key Takeaways

At New Economy, we want to help you gain control of your finances to make smart decisions. Part of that is understanding your finances and how to drive business performance.

Here are 3 key takeaways.

- The CEO needs to take ownership of being the Chief Culture Officer. And he has to encourage and hold the Leadership team accountable for building and nurturing the desired culture.

- There are no shortcuts. Building a culture takes time and lots of work. Do the work and you will reap the rewards.

- Make sure you are making investments in culture. Invest in people. Invest the time in the right meetings. Invest money in the right support to help people succeed. People who buy into your culture will champion it for you.

There you have it 🙂

New Economy Team Members are Experts in Accounting for Entrepreneurs

If identifying ways to decrease your taxes is not in your skill set or you want to gain control of your finances to make smart decisions to build and grow your business, New Economy is an excellent partner.

We’ll help you get your accounting and taxes done, and done right.

Schedule a time to meet with our Founder, Jeff, and discuss how we can add value to your situation.