3 Ways to Boost Your Confidence in Your Small Business

How Leveraging Financial Data and Your Accounting Team Can Help.

As a growth-stage entrepreneur, you’re constantly dealing with emotional highs and lows based on the various circumstances thrown your way that are not in your control.

We feel your pain.

And we have learned that this can impact the confidence you have in your small business. But what really is confidence?

Here are a few definitions.

- It is the feeling or belief that one can rely on someone or something.

- Or defined another way, a feeling of self-assurance arising from one’s appreciation of one’s own abilities or qualities.

- Or the state of feeling certain about the truth of something.

Which begs the question: Do you have confidence in your small business? And can you increase that confidence in your small business using financial data and leveraging your accounting team?

At New Economy, we believe so.

Why, you ask?

It aligns with our efforts of helping you gain control of your finances to make smart decisions to build and grow your company.

In this article, you will learn:

- What types of issues might be eroding your confidence in your small business

- What you can do to overcome these issues

- Three key takeaways related to improving the confidence in your small business using data

Let’s dive in.

What Issues May be Eroding Your Confidence in Your Small Business?

There are a few important things to discuss here.

First off, there is no silver bullet and the game of business covers a lot of ground. Therefore, we will focus on issues on the financial side of your business, which is the space that we play in. But this approach can be applied to any department such as marketing or even operations.

So what could deteriorate your confidence in your small business as it relates to the financial side of your business?

Maybe it’s people, maybe it’s process, maybe it’s technology, or maybe it’s a combination of all three.

Let’s Talk People

Start with the Right Seats

Before we dive in, let’s discuss the seats in your accountability chart. And here is a question–Do you have a sense of the right seats and core functions needed for your business based on your stage, growth trajectory, and goals?

We believe every entrepreneurial, growth-minded company needs 3 foundational seats, each with a different set of skills and unique abilities (for more, check out our blog on the difference between an Accountant, Controller, and CFO). Here they are:

- Bookkeeper / Accountant – They focus on tactical things like payroll, bill payment, bank reconciliation, credit card reconciliations, and invoicing and collections. This team member may have 3-5 years of experience.

- Controller – They focus more on the output which would be things like accurate financial statements, accounting processes, managing the Bookkeeper, and working directly with the CEO or CFO. This team member may have 10-15 years of experience.

- CFO – They focus on the business. They are a strategy partner to the CEO and they oversee everything related to accounting and finance and will get involved in budgeting, forecasting, and helping to bring plans to life. This team member may have 20+ years of experience.

Now that we have the right seats in place, you need to find the right team members and this is where people come into the picture.

Then Find the Right People to Fill Those Seats

At New Economy, we ask ourselves a few questions about placing a team member in a seat such as the ones mentioned above.

First, are they aligned with our core values at New Economy? If not, they will not be a good fit for our company, and we don’t place them. If yes, we move on to the next question.

Do they get it, want it, and have the capacity to complete the functions needed for the seat? If not, they will not be a good fit for the seat and we move on. But maybe through training and development, we can get them there. And if yes, then we place them in the seat.

So, if you don’t have the right seats, or maybe you have the right seats but the wrong person in them, you will face challenges. Chances are:

- You are frustrated

- your team member is frustrated and feeling burned out

- You are not getting financial information to make smart decisions to build and grow your business

So your confidence could be down to not having the right structure and seats in your accountability chart or not having the right people sitting in those seats.

Consider stopping doing your own bookkeeping or using Tom’s uncle’s cousin who really is a party planner! Take the time to get this right.

If you get this right, you will have an accounting and finance department that is aligned with your vision and provides useful financial data, actionable insights, and business improvements all to help you build and grow your business. This is an investment in your business that will return extraordinary results.

Let’s Talk Process

The next issue that might be eroding your confidence in your small business is the lack of process. At New Economy we are consistently reviewing our core processes, documenting them, and training others to ensure they are followed by all.

By having documented processes in your accounting and finance department you are ensuring that team members are clear on how to do things and you are mitigating the chances for errors, inefficiencies, or even fraud. Yup, we said fraud which nobody thinks about until it’s too late.

But here is the real reason the documented process is important: It will ensure that over and over again you have a procedure in place to consistently produce a desired outcome in a timely and accurate manner.

For example:

- Processes will support the release of timely and accurate financial statements. A process around the month’s end will allow any controller to step in and provide you with financial data that you can rely on to make great business decisions.

- Processes will ensure that bills are paid on time for goods and services that we have received (we have seen vendors getting paid for things they should not) and that payments are going out at the right amount per the actual purchase order and invoice.

- Processes will ensure that your business is on track to meet its annual budget. At month’s end, the actual financials can be compared to the budget to show what is on and off track. From there, you can forecast the future based on what you are learning to see how you are lining up compared to the budget.

We prefer to rely heavily on processes. The process runs the business and the people step in to run the process. This takes time and effort but it is worth addressing in all departments in your company.

So, if your accounting team is always late with providing information, missing key information, or off on the accuracy we can see why your confidence might be down. And it may be due to a lack of processes needed to support where the business is currently at today.

A few final thoughts:

Having a documented process may not be enough. We believe that team members need to be trained in processes. Further, the process needs to be followed by all. So, you need a process to ensure that processes are being followed – yikes!

But in the end, the process will give you the confidence that you are receiving financial information that is both timely and accurate. And this will give you insights as to how your business is performing.

Let’s Talk Technology

Remember the old days when you used to get a set of financial statements printed on ledger paper?

We don’t! And if someone handed us a set of financial statements on ledger paper our confidence would certainly drop. We’d question, in a healthy way, if we could rely on the numbers.

See, we have built New Economy from the ground up by leveraging a technology stack that allows us to provide virtual accounting and finance services worldwide. It’s faster, more efficient, more cost-effective, easier to build processes, and easier to train team members on how to use technology tools.

However, many companies’ accounting and finance departments are still struggling to adopt new technologies that will increase efficiencies, reduce errors, and allow team members to spend more time analyzing information and providing actionable insights.

The point is: Consider what technology you might be able to use to change the game and build your confidence.

Here are some examples:

- For bill pay consider bill.com

- For payroll consider Gusto, Rippling or Justworks

- For expense management consider Expensify

- For general ledger consider Sage, QBO, or Xero

The list goes on and on.

But the main point is that the use of technology can speed the flow of information up and assist with increasing the accuracy. Further, processes can be wrapped around these technology tools, meaning technology has an impact on increasing your confidence in your small business.

What Can We Do to Overcome the Issues that are Decreasing Your Confidence in Your Small Business?

The very first thing we suggest you do is step away from the day-to-day of the business. Most growth-stage entrepreneurs have too much on their plate and it’s hard to reflect and think strategically when you are in the business.

So what do you do?

Take clarity breaks. A clarity break is a regularly scheduled appointment on your calendar with yourself. You define what regular is – a half-hour daily, two hours weekly, a half-day monthly. It’s up to you. The doing of it is what matters.

Note: We like to take these in physical spaces that motivate, inspire, and encourage us. For example, I like to take my clarity breaks in my 1986 VW camper van by the ocean. Some team members like to take them at Starbucks. But the point is, get away from your regular space.

OK, so I am in my van, now what?

We would encourage you to reflect on the above and ask the following questions:

- Do I have the right accounting and finance seats on my accountability chart?

- Are the functions for each seat clearly defined?

- Do I have the right team member with the right skills sitting in the seat?

- Do I have processes supporting each function in these seats?

- Are the processes being followed by all? Are they evolving with the business?

- Do I have the right technology to increase productivity?

Reflecting and answering these questions will increase your confidence in your accounting and finance team and provide you with the information you need to build and grow your business such as:

- Ways to increase profits

- Ways to mitigate risks

- Ways to run smoother

- Ways to improve business insights

- And ultimately increase business confidence

We have subscribed to this approach to help build and grow New Economy. You can do this for literally any department in your business.

But should you want to get there quickly, consider hiring a company like New Economy that has done the hard work for you 🙂

And once you have the confidence in the back end of your business, you are ready to go and ready to grow. You have the foundation built to support the needs of your customers while capturing market share.

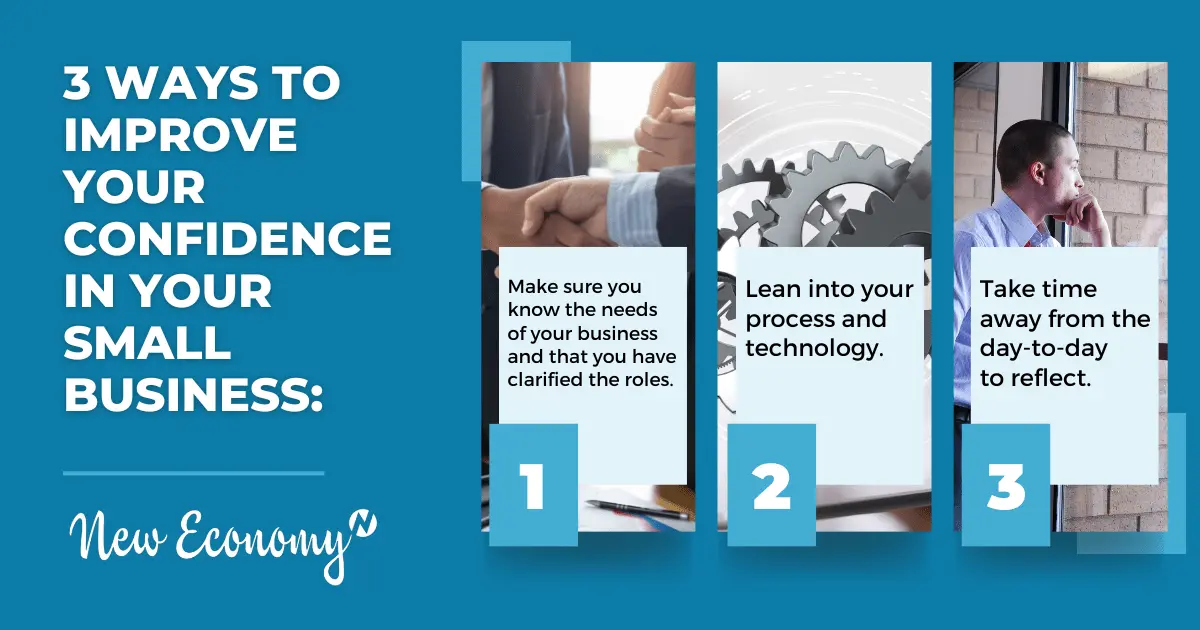

3 Key Takeaways Related to Improving Confidence in Your Small Business Using Data and Leveraging Your Accounting Team

If you want to improve your confidence in your small business, consider leveraging your accounting and finance team and the data they provide.

Here are three key takeaways related to improving your small business confidence:

- Make sure you know the needs of your business and that you have clarified the roles. Further, make sure that you have the right person with the right skill set to meet those needs by being able to perform the core functions of the role.

- Lean into your process and technology. Make sure that you have a documented process followed by all. Further, make sure that you are using the best-in-class technology for efficiency purposes.

- Take time away from the day-to-day to reflect. Think about what’s working and not working, and what next people move you need to make. This time is valuable in that it will provide new ideas and actionable insights to chase down your goals.

New Economy Team Members are Experts in Accounting for Entrepreneurs

If your Company’s accounting and finance team is not providing data to help build your confidence in your small business, let’s talk.

New Economy makes an excellent partner because we want you to gain control of your finances to make smart decisions to build and grow your business.

We’ll help you get your accounting done, and done right.

Schedule a time to meet with our Founder, Jeff, and discuss how we can add value to your situation.