Why Companies Running on EOS Need a Remote Accountant in their Accountability Chart

New Economy runs on EOS.

We successfully graduated from a full implementation of EOS with a hired implementer back in 2020. The system has been instrumental in allowing us to build our team, systems and processes, and create company alignment around mission, vision, and values. It’s also helped us support our 3.5x revenue growth since implementation.

So clearly, we see the value in the EOS system.

Further, we greatly appreciate the EOS community’s shared values which encompass an abundance and growth mindset, doing the right thing, giving before you get, and doing what you say.

We are grateful to be a part of the community and want to help others just as we have been helped.

We have unique abilities in the data component that can be leveraged to help EOS companies achieve their vision and goals.

We want to help you gain control of your finances to make smart decisions to build and grow your company.

In this article, you will learn about:

- Why to consider hiring a remote accountant and what to look for

- The proper seats and core functions to set you up for success

- The right tools and meeting rhythms

- 3 key takeaways

Let’s dive in.

What to Look for When Hiring a Remote Accountant and Why to Consider it as an Option

What to look for

New Economy is a fully remote Company. We have 15 team members in 15 different states. Further, we have 45 recurring customers that get us into another 5 states, totaling 20 states between employees and customers.

So we know firsthand that remote working works. We have leveraged the EOS tools and meeting rhythms which increase the probability of success.

We focus on:

- Lots and of Leading, Managing, Accountability (LMA)

- Focused and consistent Level 10’s, monthly check in’s, 90-day check-ins, Quarterly and annual roll-outs

- Focused and consistent weekly, monthly and quarterly scorecards

- Documented process

- Technology to support the team and customers

Further, we outsource our marketing (awesome plug for Full Stadium 🙂) and legal (awesome plug for Howell Legal 🙂) to remote Companies. So not only are we a remote and outsourced service provider but we successfully leverage the service of others

So here is tip #1 – Make sure the company has proven experience and examples of success when working in a remote environment.

Many companies are trying to take advantage of remote working but they have not invested in the technology, process, or systems. They just are not equipped to provide awesome service (core value call out).

Another key component is alignment. Being an EOS company, we have a set of core values:

- Deliver awesome customer service

- Embrace learning and growth

- Be passionate and own it

- Build open and honest relationships

- Continuous learning and growth

And we even look at our core values and seek to find alignment with our customers by asking questions during the early stages of the customer journey. Further, by leveraging our core values we have created the characteristics of our ideal customer:

- Mission-driven, values-based, and growth-minded

- Revenues and/or investor funding in excess of $2M

- 10+ Employees

- Located anywhere in the US

- Leverages technology and process

- Wants an engaged accounting and finance partner to help them use data to grow

If this is you, let’s talk.

This leads to tip #2 – Make sure there is a degree of alignment around core values, working and communication styles.

This takes a bit of hard work, but as an EOS company, we know it’s all about getting the right people in the right seats, and the right person just might be someone that is remote.

So now we have a sense of what to look for.

But why should I consider outsourcing to a remote company?

Why to consider outsourcing

Back in June we wrote a detailed blog posting giving 3 key reasons why you should consider outsourcing to a remote accountant. For your reading pleasure, we are including a link here.

But if you like summaries, here are the top 3 reasons why:

- You will likely save money as you probably don’t need a full-time hire. You won’t need to worry about space, technology, or benefits. Further, you will not be overpaying a technical person to do admin-type work. We stay in our lane and focus on what we are good at which aligns with the seats and core functions which we will talk about later.

- Considering outsourcing will require you to focus and evaluate your accountability chart, your people, your processes, and your technology. And this is a good thing for your business. It will require you to take a hard look at what is working, not working, and why. And one of the things about remote working and leveraging technology and process is effectiveness and efficiency because we have to.

- You will have a resident accounting expert on your team who does not need to be trained or managed. They work with different companies so have an inside look into many businesses and acquire best practices. They are focused and specialized in core functions that are specific to their skill set.

So, by now you should have a sense of what to look for and why to consider outsourcing to a remote accountant.

Keep reading if you want to get a glimpse of seats and core functions in the accountability chart that will help you gain control of your finances to make smart decisions to build and grow your business.

The Proper Seats and Core Functions to Set You Up for Success

ou are probably familiar with the accountability chart if you run on EOS, and if not check out this quick video here. It acts like an organizational chart by really focusing on identifying the core functions of each role.

This is all about getting the right people in the right seats and focusing on accountability for the tasks they are responsible for.

We figured the best way to explain the ideal chart for a growth-minded organization is to just show it.

We prefer to build this from the bottom up:

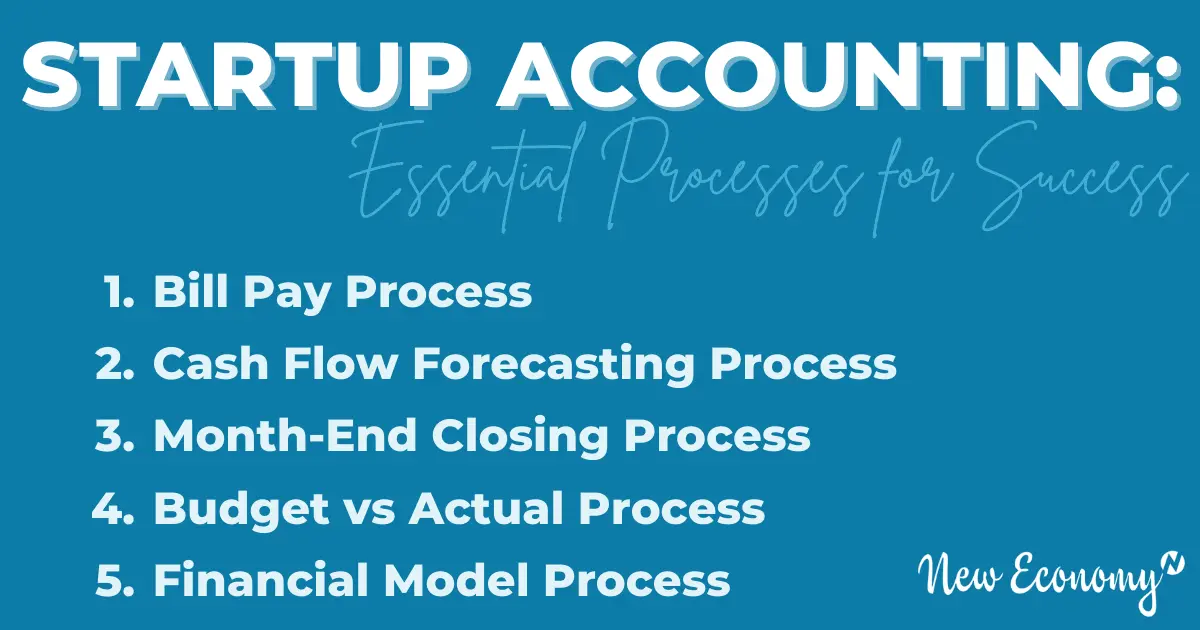

First up is your staff accountant. This team member is leveraging processes and technology to perform their core functions. They are the foundation of your accounting team. The old saying is garbage in, garbage out. The tactical inputs of this team member will be at the front end of the strategic outputs you are looking for.

| Staff/Senior Accountant

*AR and AP *Payroll *Bank & Credit Card recs *Maintain QB |

Next up is your Controller. This team member leads and manages the staff or senior accountant. Further, they work with creating processes and policies, and are focused on delivering timely and accurate financial information.

| Controller

*Lead, Manage, Accountability *Month-end close *Financial process *Budgeting & cash flow |

Next up is your CFO. This team member sits on your leadership team. They are focused on being the right hand to the CEO and supporting the overall strategy of the business.

| CFO

*Leadership *Strategy *Capital raising *Risk |

The above 3 seats are key for really every business, but it’s hard for a CFO to be effective if the foundational pieces are not in place. Remember, each role requires unique abilities and skills, so make sure you are setting everyone up for success.

Here is what a health accountability chart for a growth-minded company should look like:

| CFO

*Leadership *Strategy *Capital raising *Risk |

| Controller

*Lead, Manage, Accountability *Month end close *Financial process *Budgeting & cash flow |

| Staff/Senior Accountant

*AR and AP *Payroll *Bank & Credit Card recs *Maintain QB |

For more information on the difference between an accountant, controller and CFO, check out this blog posting here.

And here are a few pro tips:

Tip #1 – Start from the ground up. Get the tactical foundational stuff set up before bringing in a controller or CFO.

Tip #2 – Don’t over-hire. Meaning, your CFO or Controller should not be doing admin-type work. Actually, they should not be doing any work outside of the core functions listed above.

Tip #3 – The reality of it is outsourcing can save you money. Focus on the core functions which are based on specialized skills. Use Admin and operations people for all non-accountant and finance core functions.

If you are feeling pain in this area, let’s talk. We have this figured out for you so you can focus on building and growing your Company.

The Right Tools and Meeting Rhythms

Now let’s talk about tools and meeting rhythms.

The Tools

Being a fully remote company, we operate in a paperless environment with all web-based applications. There are hundreds of web-based platforms out there to meet your needs and we don’t have time to go over all of them here, but here are some essentials:

- Quickbooks Online – Maintains all of your accounting and produces your financial statements

- Bill.com – Provides bill payment solutions that automate and help with internal controls

- Expensify – Provides expense reimbursement solutions that automate and help with internal controls

- Fathom – Provides month end dashboards and analysis like budget versus actual

- Jirav – Provides budgeting and forecasting

And the list goes on. The key is to find a tool that is in the cloud and will add value to your life. The goal is to become more efficient as a result of the technology.

The Meeting Rhythms

Being remote, we live and die based on accountability. One of the ways we drive accountability is by having preset meeting rhythms. Much of this depends on the services our customers want but here is a glimpse into the preset rhythms we have in place:

Internal

- Weekly Team Level 10’s – Here we all get on the same page for what’s working, not working and solve problems

- Monthly Team member one on one – Make sure our team members are set up for success and help them with challenges and issues

- Quarterly Check-Ins – These are 90-day check-ins where we provide our team with feedback and actionable insights to help them grow.

- Monthly Culture Events – These are geared to help us grow in our relationships with each other. We are looking to build intentional connections and increase trust and credibility.

The above meetings impact our clients even though they are not a part of them. These meetings help to build our team up and provide clarity on timing, expectations, and deliverables. Most importantly they set the tone for our culture which is an internal thing that makes its way into everything we do.

Now onto our client-facing meeting rhythms:

External

- Weekly Check-ins – These are to drive alignment and build trust. They are quick meetings to “get on the same page”. Some happen in Slack and others in Zoom.

- Weekly Cash Flow – If we are doing bill pay or cash flow forecasting, we have a weekly cash flow meeting. This is to provide insights into cash flow on a rolling 13-week basis. (Read more about creating and following a cash flow model here).

- Monthly Finance Zoom – This is a fun meeting and core to our services. Here we present the financials with actionable insights. We are quickly spoon-feeding our customers relevant information from the financials to make smart decisions.

- Quarterly Tax Zoom – If we are providing tax consulting services, we connect quarterly to discuss tax opportunities and threats with the idea of providing peace of mind around taxes.

- Quarterly Budgeting Zoom – If we are providing budgeting or forecasting services we will meet quarterly to discuss what we have learned about the business and how to apply it moving forward.

Ok, that seems like a lot and there is more. Note, that we love to simplify and can combine and condense where it makes sense.

The key for us is to have preset meetings that drive engagement. This engagement allows us to provide key insights to help our customers grow their businesses.

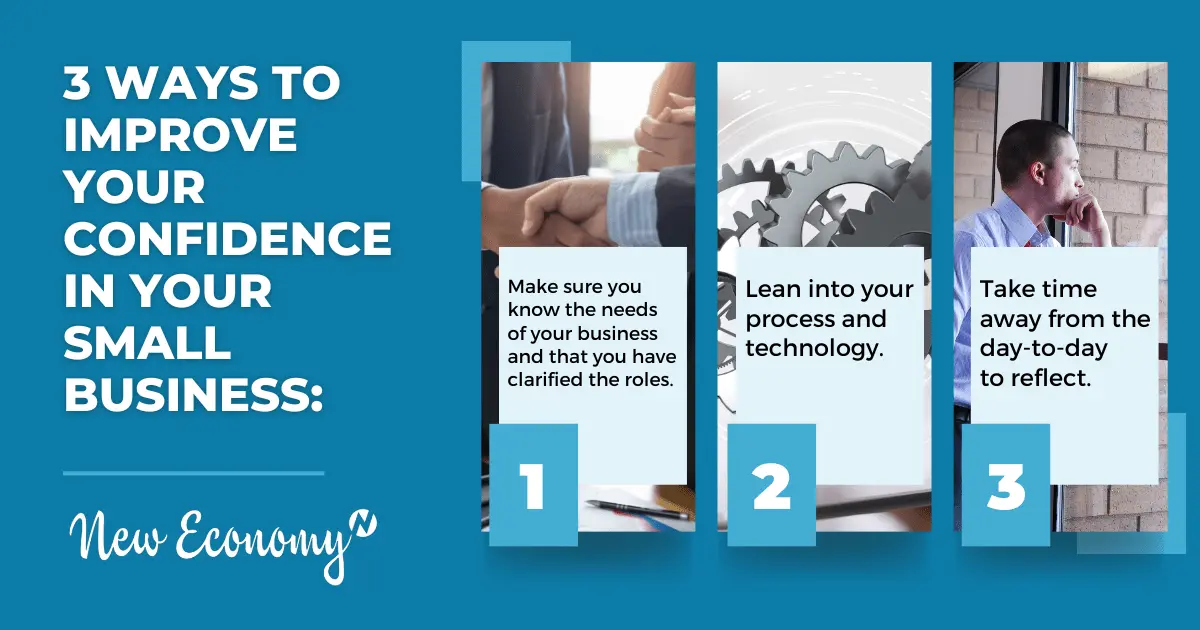

Here are three key takeaways:

You made it this far, now for the top 3 takeaways:

- Spend time reviewing your business needs as they relate to your accounting department. What’s working or not working? Get this all documented based on the above accountability chart. Once you have established the seats and functions you can then move on to getting the right people involved.

- Don’t overpay or underutilize team members. Meaning, your CFO should not be in QuickBooks doing basic accounting work. Further, your accountant should probably not be advising you on strategic business decisions. Build some depth on your team and outsourcing will provide a cost-effective way to make that happen.

- Culture. Culture. Culture. We love to focus on alignment. Make sure you take the time to align with a company that seems to have a shared value system. Ask them about their mission, vision, and values and look for areas that resonate with you. Taking your time to get the right people in place will provide tremendous value in helping you achieve your goals and allow you to focus on what’s most important.

New Economy Team Members are Experts in Accounting for Entrepreneurs

If you run on EOS and building out processes with a focus on accountability is something your business is working towards, New Economy can help. We have the right tools and meeting rhythms to ensure your core functions are being taken care of.

Again, it’s our goal to help you gain control of your finances to make smart decisions to build and grow your company.

So, Schedule a time to meet with our Founder, Jeff, and discuss how we can add value to your situation.