Top Ways Your Accounting Team Can Reduce Your Pain

You love your business.

But sometimes the accounting side of things can feel like a never-ending game of Whac-A-Mole.

And some days, you’re not the one doing the whacking, you’re the mole getting hit over the head.

Ouch.

We feel your pain.

Or, we used to.

And that’s why we love our work here at New Economy.

We love helping our clients reduce their financial pains so they can focus on greener pastures, hopefully not nearly as mole-infested.

Your accounting team has a tough job, but the end goal is to reduce your pain, not make more of it. So, let’s share some ways your accounting team is (hopefully) working to make your life better right now.

1. The Pain of Inefficiency and Wasted Time

There’s a reason for computers and AI, and it’s not to steal our jobs.

It’s to take on the work that would be otherwise boring, repetitive, or inefficient for a human to spend their brain power and time focusing on.

Embracing efficiency can help keep your business going strong.

The software exists for most of these tasks, from bank reconciliations to expense tracking. It just needs to be well-implemented.

Your accounting team can help you out with the following:

- Automate Repetitive Tasks: From invoicing to expense tracking, automation tools can handle the mundane so your team can focus on more exciting stuff. Less grunt work, more strategic thinking!

- Optimize Workflows: Implementing streamlined processes reduces the time spent on repetitive tasks, freeing up resources for more important activities.

- Improved Morale: Have you ever worked at an inefficient place that was constantly putting out fires? Compare it to somewhere that knew what was going on, had processes in place, and treated you like the intelligent person you are. Letting your employees plug into the processes, and then freeing up their minds to find innovative solutions is a great way your accounting team can help.

2. The Pain of Accounting Errors

We all make mistakes, it’s part of being human.

But how many times have your finances been thrown off by a tiny bookkeeping or accounting error?

Whether it was you or someone on the accounting team, someone spent hours, maybe even days, combing through the transactions and calculations to figure out what went wrong.

It’s a much better learning process to make interesting mistakes – like rethinking your marketing or investment strategies – compared to dealing with manual data entry errors.

And unfortunately, financial errors are more than just a headache—they can be expensive.

Here’s how your accounting team can help you avoid these pitfalls:

- Implement Checks and Balances: Regular reviews and reconciliations catch errors before they become expensive problems.

- Use Error-Prevention Tools: Some accounting software can identify potential errors before they impact your bottom line, or eliminate them by the automation we spoke about earlier.

- Invest in Training: Ensure your team is well-trained to handle – and prevent – financial task errors.

3. The Pain of Taxes

We love the benefits taxes bring to our society, but we don’t love overpaying more than our fair share.

By optimizing your tax strategy, accountants help ensure you’re paying what you owe—nothing more, nothing less.

- Strategic Tax Planning: Planning your tax strategy throughout the year avoids last-minute scramble and headaches. We know they’re coming – there’s no need to add extra stress just because it’s tax time!

- Stay Compliant: Avoid penalties by ensuring you meet all your tax obligations correctly and on time.

- Leverage Deductions and Credits: Your accountant can spot deductions and credits you might miss, ensuring you get the maximum benefit.

4. The Pain of Audits

Whether it’s an internal audit to ensure everything is in good shape or a visit from the IRS, audits strike fear into the hearts of business people around the world.

But they don’t have to be nightmares.

Your accounting team can simplify the process to make audits smoother and less stressful, with steps such as these:

- Organize Documentation: Keeping your records neat and accessible to make the audit process a breeze.

- Prepare in Advance: Regularly reviewing and preparing your documents so you’re not caught off guard during an audit.

- Working Collaboratively: While your accounting team can handle the heavy lifting of audits, the sooner you can get info to them, the easier the jobs will be for everyone. While you don’t need to be an accountant, feel free to ask questions and learn the basics, because at the end of the day, you need to understand what’s going on financially in your business.

5. The Pain of Overwhelm and Second Guessing Your Strategy

It’s easy to be overwhelmed with the decisions you make for your business. Adding a bunch of numbers and financial reports on top of that may make things even worse if you’re not someone who feels comfortable with the financial side of running a business.

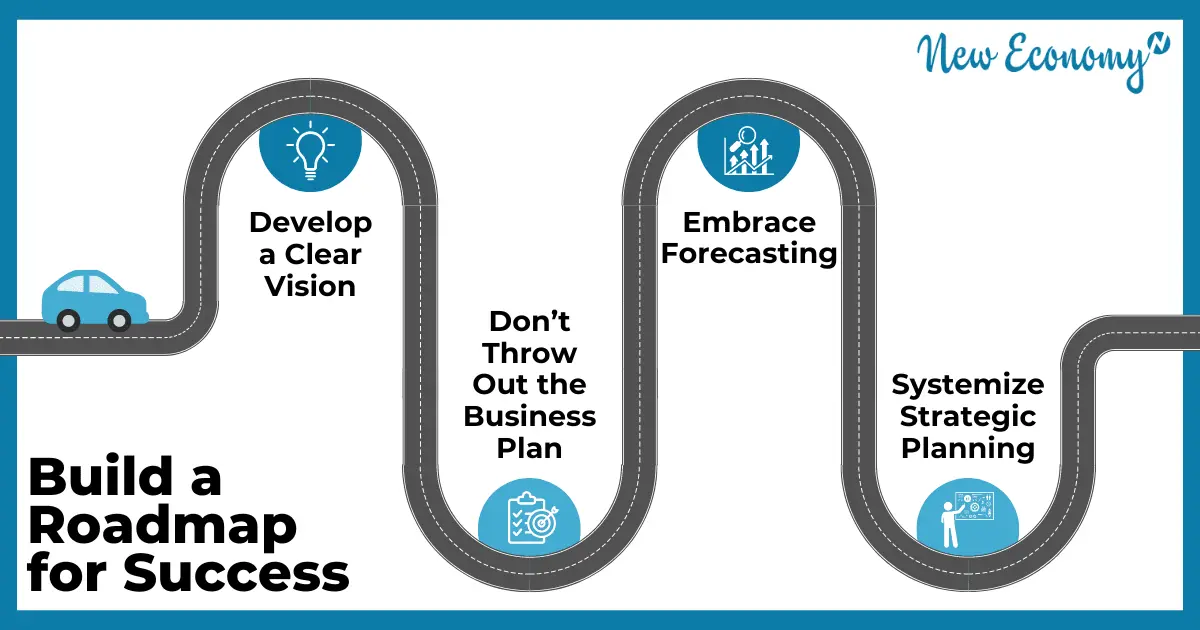

No one makes perfect decisions, but if you’re confident your numbers are accurate, and you have the correct reports, you can ask the right questions and make solid decisions.

A skilled finance and accounting team can offer expert advice and enhance financial reporting to ensure you’re not flying solo.

With their support, you’ll make informed decisions and feel more confident in your financial strategy.

They can help you by:

- Clarifying Financial Reports: Make sense of your financial statements with expert advice that turns complex data into understandable insights.

- Providing Strategic Insights: Receive guidance on making strategic decisions that align with your business goals, including tools such as business scorecards.

- Putting Together a Scorecard: Your business scorecard can be an invaluable tool.

- Supporting Big Decisions: Whether it’s expansion or cost-cutting, your accountant can provide insights and expert perspectives on the financial side to ease the process.

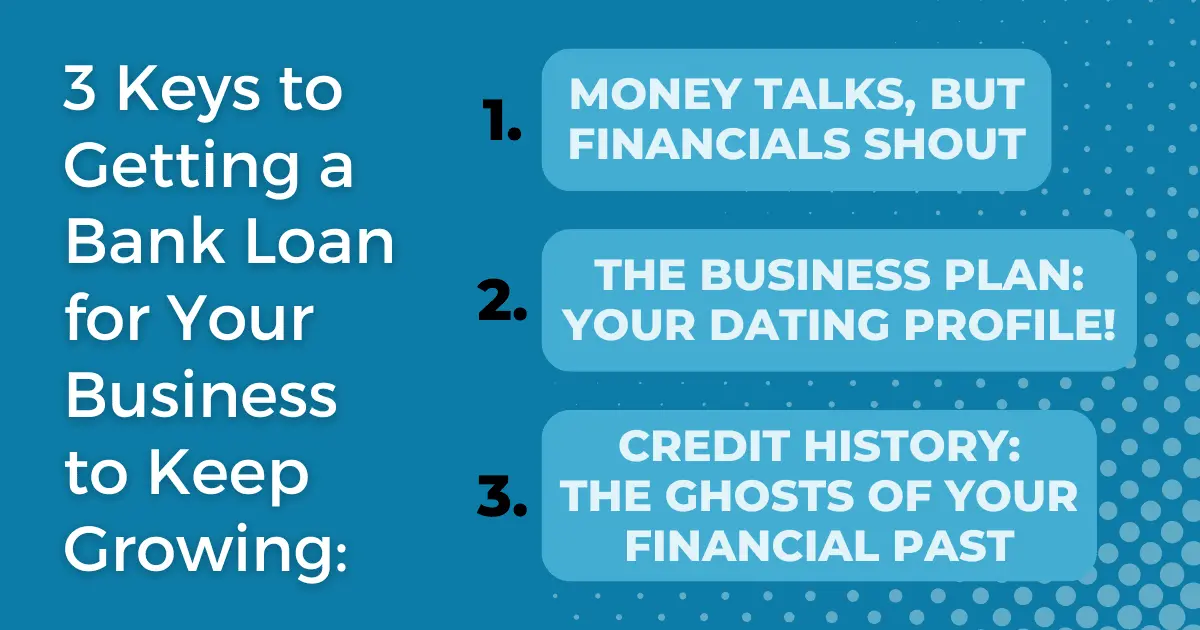

- Preparing for Funding Opportunities: Whether it’s investments or bank loans.

3 Key Takeaways

At New Economy, we help you use financials to make more money and better business decisions so you’ll feel less pain when running your business. Those poor moles need a break as much as you do!

- Streamline Your Processes (and Minimize Errors). Get rid of those repetitive tasks and reduce financial slip-ups by automating processes and leveraging efficient tools. A well-oiled accounting machine means fewer mistakes and more time to focus on what truly matters.

- Simplify Audits and Tax Strategies. By keeping your records organized and planning your taxes smartly, you’ll make these daunting tasks much more manageable. Let your accounting team take the stress out of compliance and optimization.

- Feel More Confident in Your Decisions. With clear financial reports and expert advice, you’ll be equipped to make informed decisions without second-guessing. Confidence in your financial strategy means less stress and more focus on growing your business.

There you have it 🙂

New Economy Team Members are Experts in Accounting for Entrepreneurs

If identifying ways to decrease your taxes is not in your skill set or you want to gain control of your finances to make smart decisions to build and grow your business, New Economy is an excellent partner.

We’ll help you get your accounting and taxes done, and done right.

Schedule a time to meet with our Founder, Jeff, and discuss how we can help your business survive and thrive each year!