Seeing Your Vision Through the Numbers

We were recently asked a great question by an entrepreneur on a customer discovery call.

Their question was “ What tools should my business have in place to help me see into the future ?”

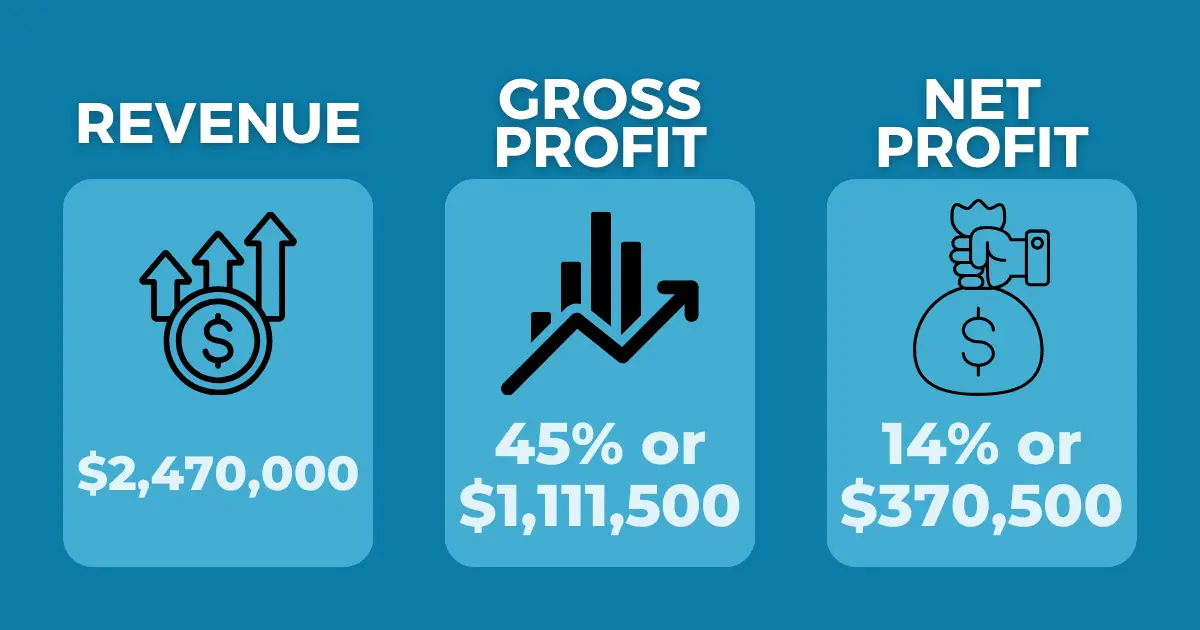

By way of background, this is a Small Business in the service industry with 18 employees and doing about $3.5M in revenue with a 15% net profit margin.

We love this question for a few different reasons.

First, it shows that the entrepreneur has a vision.

Second, the entrepreneur wants to use data to make decisions. Amazing!!!

Lastly, the entrepreneur is placing some weight on the value that his accounting and finance team can bring to the table as it relates to painting the vision through a financial lens. Doubly Amazing!!!

To quote Gino Wickman, the founder of EOS, “Vision without traction is a hallucination”.

Ain’t that the truth?

We believe a big part of gaining traction is having a clear financial vision that can be executed on a weekly, monthly, quarterly, and annual basis.

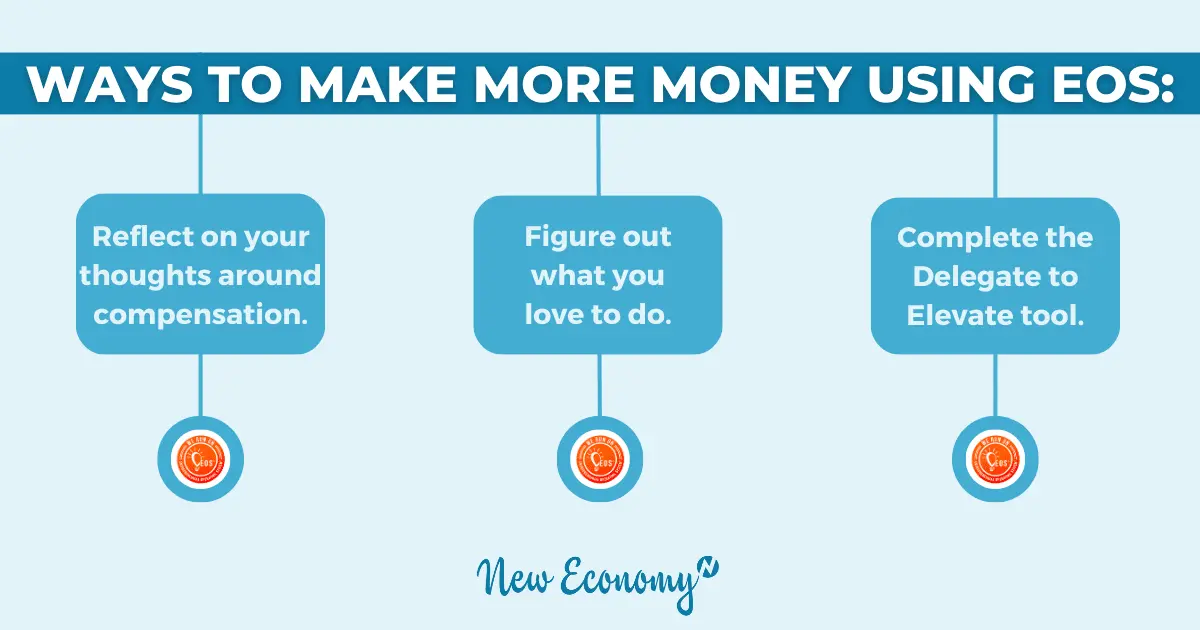

Full disclosure, we are a Company that runs on EOS, and we happen to be data experts.

The system has helped us to grow the Company 3x since graduating from implementation. Even if you don’t run on EOS, this post will surely help you out.

We know firsthand as some of the thoughts and frameworks have helped us get better.

In this article, you will learn about:

- Obstacles that get in the way of financial vision

- 2 tools to give you financial vision

- Top 3 Takeaways

Let’s dive in.

Obstacles That Get in the Way of Financial Vision

Believe it or not, the first obstacle that we often see is a lack of vision.

In Jim Collins’ article published in the Harvard Business Review on building your Company’s vision, he describes vision as having two parts.

It is a 10-30-year audacious goal along with a vivid description of what it will take to achieve that goal.

It should be inspiring, vibrant, engaging, and clearly defining the “Mountain” you are looking to climb.

At New Economy, our vision is to love Entrepreneurs into limitless possibilities.

So if you don’t have a vision, it’s time to get clear and create one.

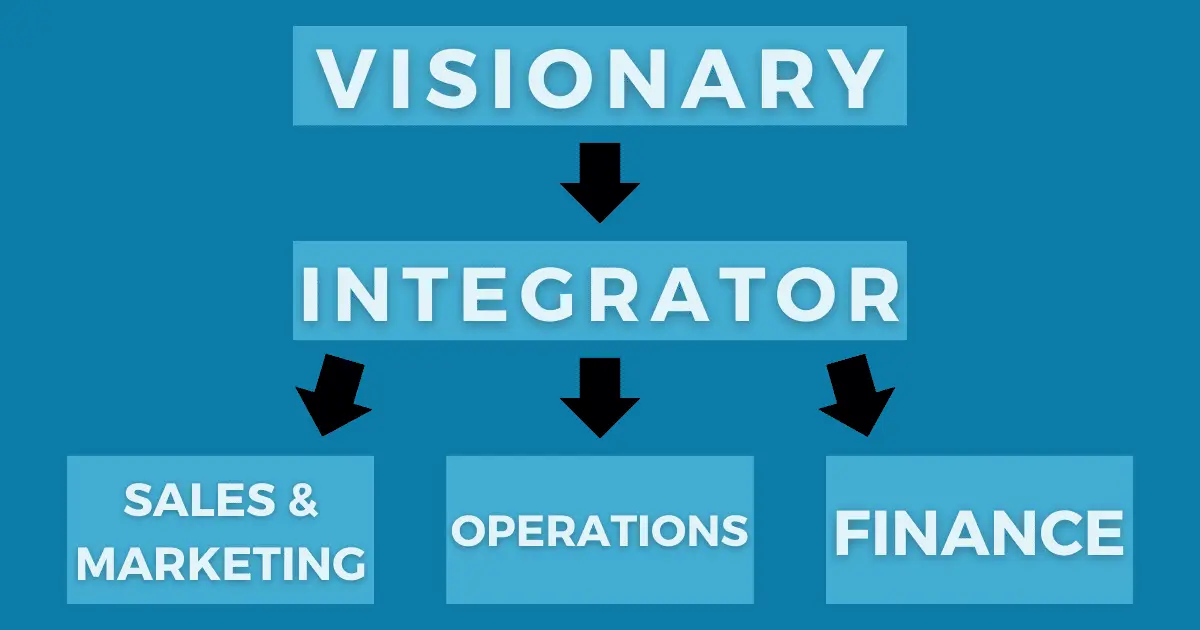

The second obstacle we see is the entrepreneur does not have the right Team in place to support the vision.

Here we are specifically speaking to the accounting and finance team and the value they can provide to support the vision.

There are key roles within the accounting team that have specific skills and functions. There are accountants, controllers and CFOs that can all play roles on the team but stepping into the vision requires specific skills.

Check out this blog on the key differences between roles here.

A mistake entrepreneurs often make is assuming their accountant can handle this role; in most cases, they can’t.

In the example of the $3.5M service Company, we believe that a strong controller will be able to support the financial engineering of the vision. They do not need a CFO and an accountant or bookkeeper does not have enough experience.

Another obstacle we see is that the Right Tools are not set up.

Once you have the vision and the right financial team in place, you can then start to think about tools.

A few things we see tools lack are the following:

- There are no forward-looking financial tools in place

- The Financial Tools are not built to allow for the running of scenarios

- The Financial Tools are not updated frequently enough

- The Financial Tools are not automated where it makes sense

- Financial Tools are disconnected from business decisions

The tools are important. They are gauges for the business like those on the dashboard of your car.

They tell you how you are doing financially against your goals and your scorecards which is an indicator of the financial condition of your business.

If you’re financially healthy, great keep investing in the vision. If you are not financially healthy, stop and fix the problem.

Great insights to have. Don’t underestimate the power of tools and their ability to paint a picture of your vision.

Summary

All of these obstacles are easily overcome by making good decisions.

First, make sure you have a vision. Then get the right financial team in place to support that vision. Lastly, empower that financial team to implement new tools to help paint the financial picture of your vision.

Keep reading to learn about the actual tools.

2 Financial Tools to display your vision

These 2 financial tools will help you with the following relating to the financial resources needed to achieve your vision:

- Make good decisions

- Have peace of mind

- Have confidence

Many entrepreneurs we have met have amazing intuition or “gut”. And we believe combining that with timely and accurate data creates a pretty awesome 1-2 punch.

Here are the two tools.

Cash flow forecasting tool

The first tool is the 13-week rolling cash flow forecast. This tool is all about future-looking cash. Imagine a world where you can see cash flow out over the next 3 months into the future.

By leveraging this tool you will have a feeling of financial security based on the ability to predict cash flow needs by:

- Know when, where, and how your cash flow needs will occur

- Know the best resources for meeting cash flow needs (Debt, Equity, Factoring)

- Be prepared to meet those needs in advance

- Set goals for building cash reserves

- Set goals for paying down debt

And how does this relate to vision?

We believe that cash flow is the jet fuel that allows you to chase down this vision.

By having visibility into your detailed cash flows you are able to get a sense of if you are able to support the investments needed to achieve your vision.

It is that simple. You will gain an understanding of your ability to invest in your vision.

Click here for a more detailed posting and to download our free cash flow tool here.

One-Year Budgeting tool

To produce cash flow, your business needs to produce a profit. In other words, when your business is profitable you will likely have cash flow.

The one-year budgeting tool is essentially your profit and loss statement budgeted out over the next 12 months into the future.

Think of your small business budget as the monthly financial roadmap to obtaining your vision.

You will gain an understanding of the overall investments needed around staffing, operating expenses, and revenue generation needed to accomplish your vision. And whether or not you will need to be profitable and produce cash flow.

Many businesses shy away from budgeting and believe it’s all “crystal ball” stuff.

In some ways it is, but it allows you to consider your vision and how you are going to fund it.

If you are interested in learning how to create a one-year budget, check out our detailed blog post here.

Here is a pro tip for you.

Once the budget is created things may go sideways. That is just the way it is.

At New Economy, we lock down the budget and forecast each month. It’s a similar format but you get to get in there and play with it, unlike the budget which is set.

A forecast is applying the information we are learning and changing the budget to reflect a more accurate picture of what is happening in the business.

But we always look back to the budget to make sure that we are heading in the direction of the original budget we set.

Summary

It takes some thought and time to put these two tools in place.

However, they are tools that are “living and breathing” just like your business. They will become instrumental in helping you to make good decisions to build and grow your business and achieve your vision. So our advice, invest to reap the benefits.

3 Key Takeaways

Your vision is very important to your business. Equally important is to ensure you have the cash and profits to chase down your vision.

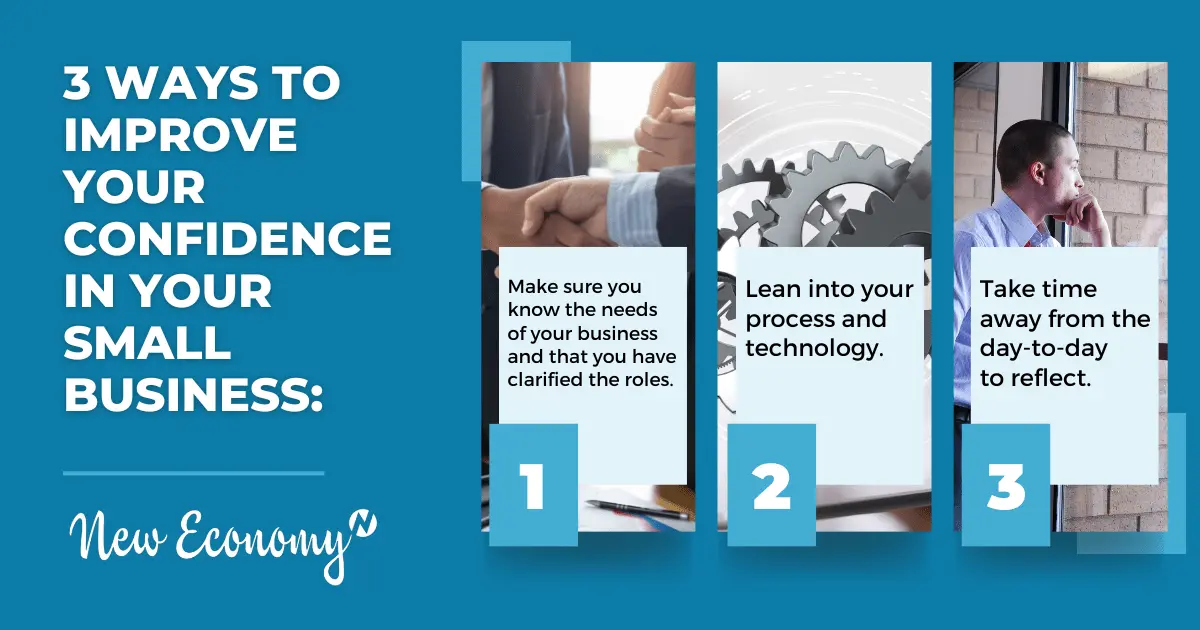

Here are 3 key takeaways.

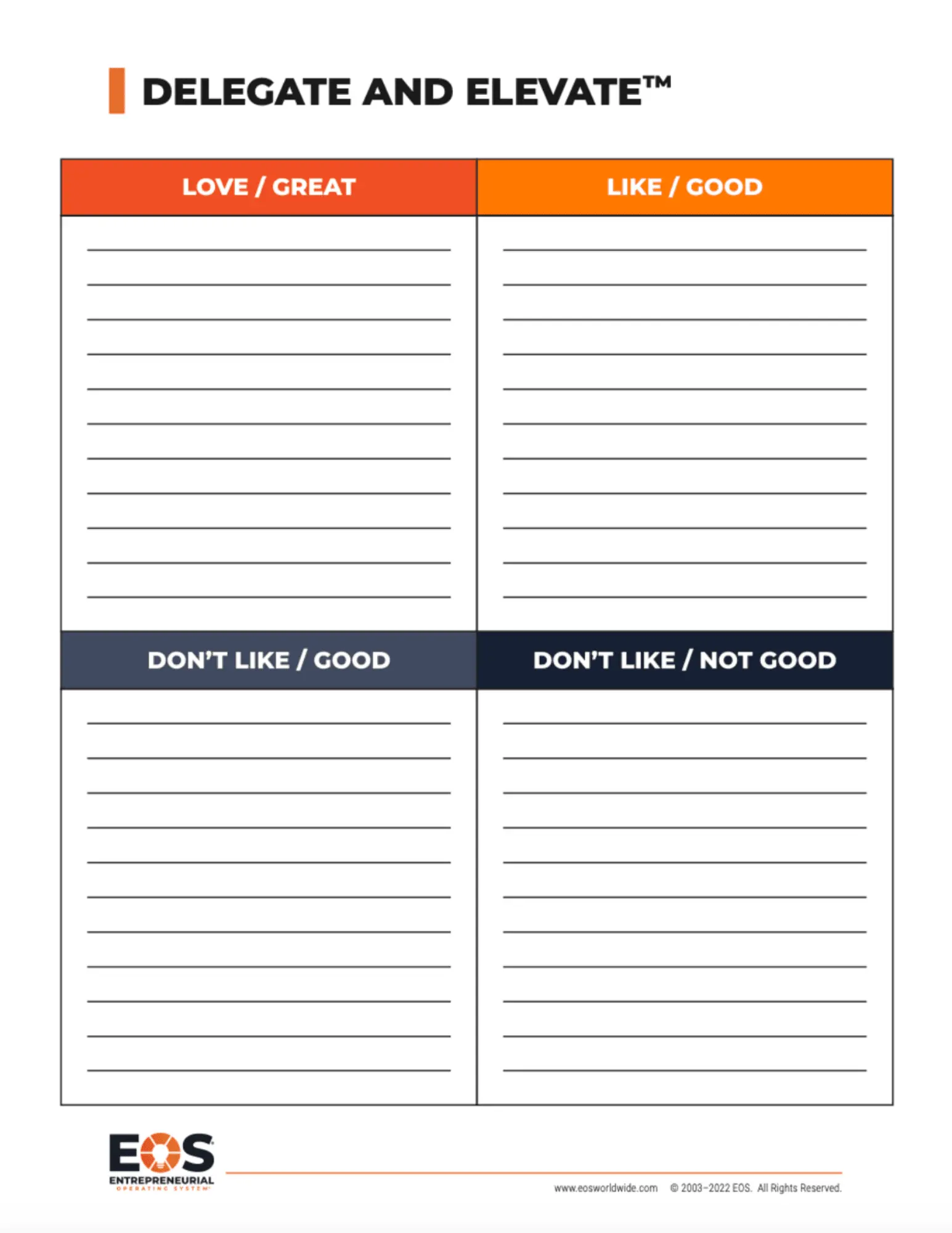

- Make sure you have your vision dialed in. You want everyone to know where you are taking them too. And also the role that they play in advancing towards the vision. This work takes time, patience, and lots of thought. Give it the time it needs.

- Make sure you have the right team in place. To produce forward-looking financial narratives that help you connect your cash resources to your vision you probably need a strong Controller on your team. They will have the right skills to help you articulate your vision in the form of a financial plan.

- Empower your accounting team to build and automate the right tools. There is an investment in pulling together both the 13-week rolling cash flow forecast and the 1-year budget. However, the benefits of having these tools in place far outweigh the investment.

There you have it 🙂

New Economy Team Members are Experts in Accounting for Entrepreneurs

If identifying ways to decrease your taxes is not in your skill set or you want to gain control of your finances to make smart decisions to build and grow your business, New Economy is an excellent partner.

We’ll help you get your accounting and taxes done, and done right.

Schedule a time to meet with our Founder, Jeff, and discuss how we can add value to your situation.