5 Financial Levers to Increase Cash and Profits in Your Growth Stage Business

As a growth-stage entrepreneur, you’re constantly thinking about ways to increase cash and profits in your Company. The more profitable you are, the more cash you can invest in people and strategies to support your growth.

Sounds simple, right?

At New Economy, we’ve used some of these tactics ourselves to grow our revenue from $0 to $2M with a gross profit margin of 50% and net profit of 15%.

And we want to help you gain control of your finances to make smart decisions to build and grow your Company.

In this article, you will learn about:

- 7 key financial levers to increase cash and profits and the impact

- Top 3 takeaways

Let’s dive in.

What are the 5 Key Financial Drivers to Increase Cash and Profits?

First off, every business is unique and things vary from industry to industry. However, we believe that there are 5 drivers that each business should focus on.

Here they are:

1. The first driver is Price. Certainly, we all know what price is defined as. It is what we are charging our customers for our goods and services.

At New Economy, we are being innovative on the pricing front. For instance, we are focused on what we call value-based pricing. We are not thinking about rate and time but more about the value we are producing for our customers. This requires a deep understanding of the customer’s needs, wants, challenges, and goals. From there the goal is to add value to help them meet their goals, remove obstacles, and provide for needs and wants.

For example, as it relates to achieving goals, it might take us 15 minutes to come up with a solution that will save a customer $50,000 which increases their net profit. We believe the value of that is worth much more than the time that we put into it. So if priced hourly, we would price the service out at $37.50 (15 min x $150) versus pricing it out based on the value, which would be more of an art and say $2,500. Would you pay $2,500 to save $50,000? I know I would.

Here are a few quick questions for you relating to price.

- Do you have a process for increasing your prices?

- When was the last time you increased your price?

- How are you determining your price?

- Is your price truly representative of the value you are adding to the marketplace?

2. The second driver is Volume. This is the number of units, services, or hours that you are providing to your customers. Getting back to knowing your customer, is there an opportunity to continue to support their group by adding more of what you do?

We have a customer that installs accessibility equipment in people’s homes to help them age in place safely – a noble mission. They have a contract in place with Veterans Affairs (VA) in several states. Through understanding some of the VA’s challenges, they learned that the VA had veterans from other states in need. The customer then helped to support the VA and its veterans by expanding its geographical footprint. This ultimately led to installing more units, thus increasing the volume which drove up revenue. And as we know, increasing revenue can increase profitability.

More questions for you.

- Can you increase the number of units, services, or hours you are selling to existing customers, and how?

- Can you offer a different service to your existing customers that will add value in a new way?

- Can you enter into new geographic markets and offer value to new customers?

3. The next driver is Direct Costs or Cost of Goods sold. These are the costs that are directly related to producing your revenue. They are your raw materials or your direct labor. These costs are variable with revenue so if revenue goes up then these costs will typically increase as well. But is there a way to decrease them?

Here are a few thoughts on reducing COGS to increase profitability:

- Stop making products that don’t sell. There are carrying costs such as warehousing, insurance, and transportation that are tied to this. Get rid of old inventory and stop making it all together.

- Negotiate with everyone. Work with your suppliers and look for volume and payment discounts. Also, periodically shop around for other suppliers that might be able to deliver the same value but at a lower cost.

- Automate your processes. Maybe you can use a just-in-time inventory system. Or maybe you can create efficiencies by reviewing your purchasing process which will add to cost savings.

The things to consider here are…

- How you can drive these costs down while still being able to deliver value to your customer?

- When was the last time you took advantage of pricing or volume discounts?

- When was the last time you negotiated on your pricing?

4. The next driver is Operating expenses. These are overhead-type costs like rent, insurance, general and administrative costs, software costs, and general salaries and benefits.

This is an area where we have a bit more control than we think. See if revenue is down, there is still a way to hit your net profit percentage by understanding which expenses are necessary to achieve your goals and reducing those that might not be.

Over the past few years, businesses have been challenged in many ways with Covid, supply chain issues, and even finding good help. Further, on the customer side, folks have been much more cautious about spending due to the recession.

We have a customer that provides software directly to consumers in the form of subscriptions. Due to the market downturn, the customer was not hitting their revenue projections. However, they knew that their operating expenses should be 30% of their revenue (they have a budget), so they reviewed their operating expenses, and here is what they did.

- They ran a few different scenarios to determine the budgeted profitability by reducing overall operating expenses by 5%, 10%, and 15%. They determine that a 10% cut in operating expenses would still allow them to achieve their budgeted profit of 15%

- They went line item by line item through their operating expenses and asked the question, does this expense get us closer to achieving our goals?

- They were able to side with which operating expenses to reduce or completely cut out of their revised budget and started managing against it.

By managing, reducing, and cutting out unnecessary operating expenses, you can achieve your profitability goals even without increasing revenue.

5. The final drivers relate to balance sheet items. Here we are focused on increasing the speed at which we collect on Accounts Receivable and decreasing the speed at which we pay vendors on Accounts Payable. Or possibly even increase the speed at which we pay vendors to take advantage of early payment discounts.

These two levers are pretty straightforward and are pulled by your accountant. Here are some thoughts about increasing cash flow by pulling on these levers:

- Utilize a 13-week rolling cash flow forecast for visibility and decision-making (see NE Blog on this)

- Set goals and measure them weekly on AR collections; Have your accountant take ownership of them

- Review all of your vendors and see if they offer any early payment discounts that you can take advantage of

We have several customers that have leveraged our 13-week rolling cash flow forecast. This has provided tremendous opportunity and visibility into finding ways to accelerate cash flows.

3 Key Takeaways Related to Increasing Your Cash Flow and Profitability

If you want to build and grow your business, you need to make sure you are focusing on its data components. This will provide assurance that you are maximizing your profits, ultimately increasing your cash flow.

Here are three key takeaways:

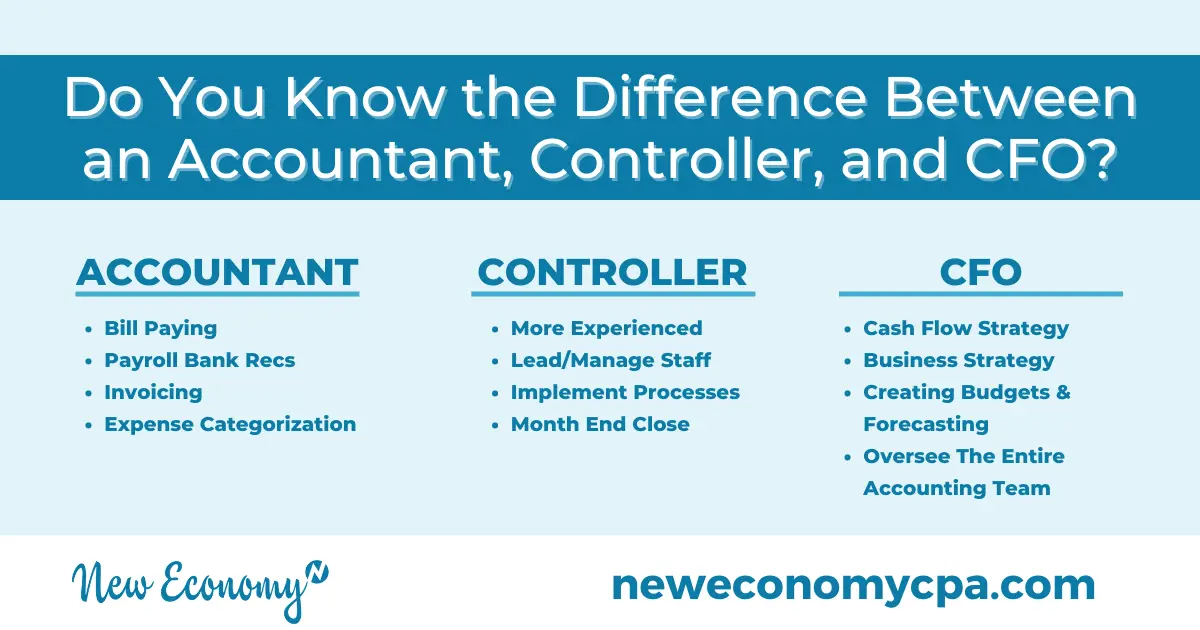

- Make sure you have someone get into the weeds and understand the impact of the above-mentioned levers. In fact, we suggest completely delegating ownership of this to a capable person like a fractional controller. Functions like this will be in their sweet spot and they can take ownership of helping you to move the needle here (Refer to our blog on fractional controllers).

- Expect a positive return on implementing these exercises. We believe that expectations should be created and then you should drive toward those results. We suggest recalibrating your weekly scorecard with new goals and aligning your work to produce the results. Further, consider updating your financial projections based on the revised goals and the levers you are pulling (refer to our blog on financial projections).

- Lastly, start slow and go deep. Select one of these areas and have your team spend 90 days working on it. Take the time to see if your revised goals are accurate and if not, understand why. Once you have mastered one of the techniques and achieved the results you are looking for, only then move on to the next lever.

New Economy Team Members are Experts in Accounting for Entrepreneurs

If identifying ways to increase your cash or profitability is not in your skill set or you want to gain control of your finances to make smart decisions to build and grow your business, New Economy is an excellent partner.

We’ll help you get your accounting done, and done right.

Schedule a time to meet with our Founder, Jeff, and discuss how we can add value to your situation.